Implementation of Blockchain for Secure, Transparent, and Trustworthy Cross-Border Payments in Global Banking

(Research)

Tanveer Ahmed Siddquee

Motijheel Branch, Bangladesh Development Bank PLC, Dhaka, Bangladesh.

Article DOI: https://doi.org/10.70715/jitcai.2024.v2.i2.017

Abstract

This paper investigated the application of the blockchain as an innovative solution for secure, transparent and confident cross border payments in global banking. This research was motivated by the existing problems of legacy systems high transactional costs, lengthy processing time frames, security issues and opacity had eroded both efficiency and user faith. The purposes were to investigate if the blockchain could improve security, transparency, trust, efficiency, adoption intention and use satisfaction of international transactions. The study design was quantitative in nature, and a structured questionnaire was used to collect data via a sampling of banking professionals, fintech gurus, corporate clients and cross-border payers. Data were analyzed through descriptive statistics and frequency distribution to find out the perception of respondents towards water quality and pattern. The findings showed that the majority of respondents have experienced inefficiencies in the current systems and were confident blockchain will provide a remedy by offering tamper-proof records, real-time tracking of transactions, reduced cost, and faster processing. In addition, the results also showed high adoption intention and favorable satisfaction expectations, which means that blockchain has potential to reshape global banking by decreasing dependence on intermediaries and increasing confidence in institutions. The research indicated that effective implementation may dependent upon clarity of regulation, readiness of organizations and awareness of users. In summary, we certify that blockchain technology has potential to revolutionize cross-border payments and improve the financial global integrations.

Keywords: Blockchain, Security, Transparency, Efficiency, Cross Border Payments, Global Banking.

1. Introduction

Cross-border payments are the lifeblood of international trade, investment and remittance flows in short, they’re the beating heart of global banking (Robinson et al., 2024). Traditional cross-border payment schemes, however, are commonly criticized for being inefficient high cost, slow settlement, exposure to fraud and multiple intermediaries and lack of transparency (X. Wang, 2022). And these challenges erode customer trust, while also inhibiting the free flow of capital across borders and subverting financial inclusion and global economic integration (Islam et al., 2024). As global trade intensifies and digital banking technologies advance, the need for secure, transparent and reliable payment systems has never been greater (Md Sharfuddin et al., 2025). Blockchain has been proposed as a solution to these inefficiencies, providing decentralized and immutable system for recording and validating financial transactions (Halimuzzaman et al., 2024). Unlike traditional banking systems, where the need for intermediaries costs you a fortune especially when exchanging across borders, settlement can take days instead of within seconds which is unacceptable in today’s fast moving society but through blockchain you have cost efficiency and real time tracking, closely monitored under secure measures; giving the highest degree of transparency (Yadav et al., 2024). These characteristics have spurred increasing interest from regulators, banks and fintech firms seeking to modernize cross-border financial systems (Alevizos & Ta, 2024). Other opportunities exist, but despite its potential, widespread adoption of blockchain in cross-border banking is nascent, with questions still hovering about on adoption, regulations and oversight frameworks, institutional preparedness and customer acceptance (Alam et al., 2021). Unlike previous research of the pilots of blockchain technologies, our study presents representative evidence from global banking practitioners on a large scale and measures determinants in an empirically validated model.

This research aimed to assess the actual potential of blockchain as applied to cross-border payments in world-wide banking, specifically, by exploring its expected benefits related to security, transparency trust, and efficiency adoption intention and user satisfaction. Taking a quantitative approach to research and gathering empirical evidence from banking professionals, fintech specialists, corporate users and individuals engaged in cross-border transactions, the study sought to indicate how blockchain can bring improvements over current traditional systems. The results can inform literature with insights into blockchain in finance, suggest potential possible strategies for policy makers and financial institutions to implement blockchain technology, while providing insight into regulatory and operational barriers that need to be overcome regarding the use of this technology. This paper aimed in the end to figure out if it’s safe and accurate, that we could use blockchain as the underlying infrastructure of global banking in future.

2. Literature Review

Blockchain, which entered the scene with Bitcoin in 2008, has emerged as a fast-growing disruptive technology affecting numerous industries and finance is not immune (Rajest & Regin, 2024). Blockchain is different from the classical centralized model as runs on a decentralized and distributed ledger, which ascertains immutability, transparency and tamper-resistance (Baftijari et al., 2024). It’s potential to disrupt the guarantors of transfers, settlements, payments and remittances, banks globally has been hailed by financial institutions as a boon that can result in cost savings from intermediation (Shams & Hamdan, 2023). Cross-border banking, inefficient by its very nature has had blockchain as a disrupted challenger to provide efficient and transparent transactions (Noch, 2024). Securing international finance is one of the most important problems at present. Centralized holding of data in the traditional systems has created susceptibility to fraud, identity theft and hacking (Putra et al., 2024). Blockchain increases security by writing transactions into permanent blocks and protecting them via cryptology. Smart contracts have demonstrated a decrease of human involvement and decrease fraud by executing terms automatically (Zulaikha et al., 2024). This is why blockchain is increasingly considered by some to be a way of protecting the security apparatus that underlies global banking. Lack of transparency in cross-border payments (such as hidden fees, non-transparent exchange rate and limited traceability) has always been the key barrier preventing trust from the customers side (Adrian et al., 2023). Blockchain provides real-time recordkeeping of all transactions, auditable records and an open ledger system that everyone gets to observe without causing tampering. Studies emphasized that the transparency was not only a cost-reducing factor, but also creates compliance with international rules and anti-money laundering efforts (Devisri et al., 2024). This visibility-bolstering capability makes blockchain a strong driver of responsible banking. Trust is fundamental to banking and, above all, to relationships with customers. Existing networks with central third party sometimes fail to be trusted because of low efficiency or corruption (Udeh et al., 2024). Through blockchain, TS builds capacity not to depend on intermediaries and trust mechanisms (e.g., a network of peers); it does so by allowing for P2P transactions to be validated by a distributed network. According to (Lu et al., 2024), the disintermediation of blockchain guarantees integrity and includes confidence to international payment systems. Studies also indicate that in conjunction with regulation, blockchain can strengthen institutional trust and alter perception among customers of transnational banks (Halimuzzaman & Sharma, 2024). Conventional international money transfers usually require a number of intermediaries in addition to several days' time, which results in relatively high service charges and exchange rate depreciation (Niu & Kantorovitch, 2024). Blockchain has demonstrated the ability to reduce settlement times from days to seconds and lower operational costs by circumventing intermediaries (Hossen et al., 2025). (Syarkani et al., 2024) also mentioned that blockchain could save the global banking sector billions of dollars a year through increased efficiency in settlement and clearing process. There are few greater advantages for global trade, remittances and multinational firms. However, the adoption of blockchain technology in worldwide banking has yet to be widespread (Bhuiyan et al., 2025). Some studies arose barriers to the implementation like uncertainty in regulation, technology immaturity and institutional unpreparedness (Ugo et al., 2024). Nevertheless, perceived security, efficacy and transparency have been reported to affect user adoption (Norbu et al., 2024). And banks that have been testing blockchain pilots like Ripple and JPMorgan’s Quorum have shown increasing confidence in its application, suggesting a slow increase in mainstream adoption (Hashimzai & Ahmadzai, 2024). Service speed, reliability, cost and security influences customer satisfaction in cross- border payment (Agrawal & Verma, 2024). Potential for satisfaction increases is high since blockchain can solve pain points that exist in legacy systems. A study by (Keerthana, 2024) showed that more than 70% of banking executives expected blockchain to the level transforming customer experience including real time settlements are reducing fees. However, issues concerning scalability, interoperability and global regulatory environment are persisting barriers to the extensive deployment. The available literature (Norbu et al., 2024), however is predominantly characterized by conceptual (not empirical) examination of use level intention to adopt cross-border banking in emerging markets. This research fills this gap with a quantitative use across professions.

There is a rich stream of literature emphasizing the transformative effect of blockchain in finance, but there are relatively few empirical studies examining the real-life impact of it on cross-border banking payments. A large proportion of the research is based on theoretical models or pilot projects, rather than measuring users' perceptions and acceptance intentions. This gap indicates the necessity of a quantitative investigation to assess how bankers, corporate clients, and end-users perceive the benefits and challenges associated with blockchain within real-world scenarios. To fill-up these gap, the study was conducted to achieve the following objectives:

1. To explore the potential of blockchain for enhancing security, transparency and trust in cross-border payments.

2. To assess performance and cost of transaction cleared through blockchain in comparison to legacy alternatives.

3. To examine the determinants of blockchain adoption intention in the global banking sector.

4. To investigate the effects of adopting blockchain on customer satisfaction in cross-border payments.

5. To reveal challenges faced by and implications of blockchain adoption for international banks.

3. Methods and Methodology

The research used a quantitative method of research through the use of structured questionnaire and closed-ended questions. Pilot testing with 60 participants were done to guarantee clarity and validity. The internal consistency of the constructs was ensured by Cronbach’s alpha, which exceeded 0.70 in all constructs. Banks and fintech companies were chosen using stratified random sampling. Ethical approval was granted, and informed consent by participants with confidentiality were assured regarding their participation on voluntary basis. Information was obtained through a well-structured checklist, and then served to bankers, fintech experts, corporate customers as well as individual users involving in the international financial business. Sample size sample estimation was done by using Cochran's formula,

Where Z= 1.96 for a 95% confidence level, p= 0.5 assuming maximum variability and E=0.05 margin of error (Cochran, 1942). According to this estimate, the optimal sample size was 384 individuals and we increased it to 400 people for non-response. Participants were proportionally sampled through stratified random sampling based on professional status and level of experience. Descriptive statistics and frequency distribution were employed as tests to analyze the collected data to capture views about security, transparency, trust effectiveness of blockchain and intention of adoption and satisfaction in using it respectively. This approach made it possible to systematically evaluate the pros and cons of implementing blockchain technology in the worldwide banking industry.

4. Result and Discussion

This section discusses the results of a study on possible application of blockchain for secure, transparent and trustworthy cross-border settlement in global banking. The findings are structured based on the respondent’s perceptions of security, transparency, trustworthiness, and efficiency and adoption intention of blockchain as well as user satisfaction. These findings are discussed in the context of the current literature and implications for existing cross-border payments technology, including how blockchain has the potential to overcome some of those limitations and also potential challenges and implications for global banking.

4.1 Demographic Information of the Respondents

The study, which sought information on the background of participants as well as to test for representation across gender, age, profession, banking experience and cross-border payment activity measures.

Figure 1: Demographic Information of the Respondents.

Figure 1 shows that, of the 400 respondents, 56% were male and 44 % female, suggesting a close balance between males and females. This also corresponds in the previous findings where fintech and banking studies typically have almost equal number of male and female participants, indicating an increasing inclusivity within financial service industries (Juita et al., 2023). In terms of age, the largest proportion (42%) were between 25 to 34 years old and followed by 28% who were aged between 35 to 44 years. This suggests that cross-border payment is a landscape for mid-career professionals and answers to the findings of other researchers showing activity in digital financial services and tech use goes on to adulthood. In terms of professions, 38% were from the banking field, 30% were corporate users and 20% were fintech professionals as well as dairy consultants or researchers (12%) confirming a variety of service providers and end-users involved in cross-border payments. This diversity enables a broader understanding of views on blockchain adoption among stakeholders (Z.-J. Wang et al., 2023). In terms of banking experience, 34% had 3-5 years, 28% had 6-10 years and another 20% more than 10 years’ work experience in the bank, which meant that majority of respondents could offer valid opinions about payment systems (Bellamkonda, 2024). Lastly, by frequency of cross-border payments, 35% of them do so sometimes (3–5 times a year), 25% often (6–12 times) and 15% very often (more than 12 times a year) the sample was quite an active international transaction beneficiary or receiver which increases reliability on their perception about the benefits and challenges related to blockchain. Overall, the demographic composition suggests that a representative sample was reached across gender, age, profession and experience, which serves as a strong premise for studying attitudes towards blockchain adoption in cross-border payment transaction. These results confirm previous research focusing on the role of user characteristics in technology acceptance and financial innovation adoption.

1.1. 4.2 Blockchain and Security

Respondents' attitudes toward feeling secure in the current cross-border payment environment and how blockchain could be the answer were researched.

Figure 2: Blockchain for Cross-Border Security.

Figure 2 showed that many had experienced problems with fraud and security 62% said this was the case, having experienced issues like unauthorized access, late settlement or hidden fees for traditional cross-border payments. This observation is consistent with prior research that highlights the susceptibly of central systems to fraud and hacking. When asked to identify the most urgent problems in traditional systems security, respondents selected delayed transactions (30%), identity theft and data leaks (25%), unauthorized withdrawals (20%) and non-transparency of decision-making process (15%), whereas other 10% mentioned possible phishing or money-laundering threats. These findings somehow validate that the traditional dependence on numerous intermediaries opens up vulnerabilities for fraud and waste (Udeh et al., 2024). Such security features when assessing blockchain include imovable records (38%), end-to-end encryption (28%) and decentralization (22%), closely followed by investment in smart contract automation. This distribution indicates that respondents were aware of the technical functionality of blockchain to reduce fraud with tamper resistant data and transparent verification. Lastly, on the question of blockchain’s potential in reducing fraud, 40% thought it could eliminate fraudulent activities often, 35% felt that they could work most times and only 15% said occasionally and only a mere 10% answered remain skeptical. This general positivity with blockchain for cross-border payments suggests that a secured alternative to traditional currency exchanges is believed in by the majority, but minority of skeptics can be justified by literature stating rising risks such as 51% attacks and smart contract flaws are still in need of controlling regulation and technological improvement (Md Sharfuddin et al., 2025). Overall, the results illustrated that survey participants believed traditional cross-border systems were extremely insecure; in contrast blockchain was seen as a revolution of security towards decentralization, immutability and encryption. But the debate also highlights the necessity of strong regulatory structures and technical safeties to realize blockchain’s security promise in reality.

4.3 Transparency

Transparency has always been a weak spot for legacy cross border payment tools which often include hidden and marked-up fees, little real-time visibility, and obscured currency pricing.

Figure 3: Transparency Challenges in Cross-Border Payment.

Figure 3 represents that, the survey found that 68% believe traditional cross-border payments to be a blackbox with respondents saying they did not have access to information about fees and little visibility into where funds are throughout the transaction process. Traditional Novice Systems Only one in five (22%) said traditional systems were even moderately transparent, with 10% seeing no cause for alarm evidence of ongoing discontent with bricks-and-mortar banking practices. These results are in line with (Baftijari et al., 2024) that highlighted opacity as a major obstacle to user trust in cross-border payments. Queried on which transparency factor was the single most challenging problem in traditional systems, hidden transaction fees (32%) took the top spot but certainly had company as a second-place finish for delayed or opaque settlements (28%), while unclear currency conversion rates (25%) and accessibility to transaction history (15%) rounded out other responses. This is consistent with the literature that criticized traditional systems for their reliance on intermediaries and a lack of industry-wide means to disclose information. In terms of the contribution from blockchain, real-time tracking of transactions (36%), public record that cannot be altered (30%) and decreased dependence on intermediaries (20%) were cited as the most valuable features enhancing transparency, and automated compliance reporting was also recognized. Respondents also stressed that the possibility of independently verifying transactions with XRP had raised confidence in cross-border payments. As for effectiveness, 42% of respondents thought that blockchain would greatly improve transparency, a further 33% thought it would increase visibility somewhat, only 15% didn’t know and 10% were skeptical because they don’t trust blockchain’s ability alone to solve the problem it could also end up making issues around technical complexity and uncertainty over regulatory oversight worse. These views are in line with the findings of (Adrian et al., 2023) observed the chain as promoting transparency while complying regulatory-matched frameworks contributes heavily on trust in CAPS. In general, we found that while traditional systems are perceived to be opaque and have hidden costs, blockchain is commonly viewed as a mechanism enable transparency through auditable records, open validation, and real-time tracking. But it also serves as an illustration of the need for institutional adoption and regulation on all sides if transparency returns are to be achieved in reality. Both groups appreciated transparency, but bankers saw it as a compliance or auditability tool and fintech experts regarded it as necessary for peer-to-peer accountability and trust within the ecosystem.

4.4 Trust in Blockchain Banking

Trust is one of the most important supporting columns for cross-border banking, seeing how users need to trust in the credibility of entities and systems that will guarantee that their money are handled safely.

Figure 4: Trust in Cross-Border Banking Systems.

Figure 4 illustrates that, the findings from this survey show that 61% of participants were not confident in traditional cross-border banking systems as they incorporated various intermediaries and high fees, delayed settlements, lack of transparency respectively. Moderate trust was declared by only 26% and high trust by only 13%, reflecting a strong aversion against established systems. This result is in line with (Adrian et al., 2023), who noted that depending on centralized intermediaries largely damaged customers trust in international bank transactions. Given the option to list more than one thing that played into how much they trusted traditional systems, hidden costs (30%), transaction delays (27%) and having problems in the past with fraud or disputes (22%) were named most often, followed by a lack of transparency at 21%. Such responses serve to highlight that the absence of accountability in traditional systems continues to impede persistent end-user trust. Respondents also specified certain blockchain attributes that build trust. Decentralization and locational independence/low reliance on third party (34%); immutability of transactional data (28%) and end to end encryption (25%) are seen as the most trust enhancing properties while smart contracts for automatic triggering when a con exposure takes place is only 13%. These perceptions are in line with (Zulaikha et al., 2024), who emphasized the potential of blockchains to ensure integrity, security and verifiability in financial transactions. Carrying this theme through to the question of blockchain’s power as a means to build trust, 44% said they think it would have a high impact on trust in cross-border payments, while 32% thought it could have a moderate impact and just over 14% were unsure and only two out of every ten remained skeptical hiding behind concerns for regulation confusion and fears around technical risk. This optimism is in line with an increasing consensus that blockchain can change the banking industry and move from trust placed on institutions towards system based trust, where its technology rather than intermediaries embedded in the fabric of finance. In conclusion, the results reveal that trust in conventional cross-border systems is eroded by opacity, delays, and fraud risks, while decentralization, immutability and transparency characteristics of blockchain are broadly considered as ways to restore user trust. But the conversation also highlights that winning long-term trust will be more than a function of technological reliability it’s also going to rely on regulatory alignment, and an institutional embrace of blockchain technology. The subgroup analysis showed that fintech respondents had more trust in the decentralized feature of blockchain, while traditional bankers held moderately optimistic attitudes and highlighted towards authoritative supervision for the robustness of trust. This conceptual convergence implies that transferring adoption models of blockchain-based banking service should be theoretically anchored on TAM, are focusing on the significance of perceived usefulness and trust in shaping the adoption.

4.5 Efficiency and Cost Effectiveness

Traditional cross-border payment systems, usually plagued by a chain of agents, protracted settlement duration and overcharges, still suffer severely from the inefficiency and expensive costs.

Figure 5: Efficiency and Cost Effectiveness of Blockchain Banking.

Figure 5 explains that, 72% of the respondents considered traditional solutions as slow and expensive, with delays, intermediary fees and unfair exchange rates identified as significant barriers to financial access in the KYC process. And only 18% said that traditional methods are moderately effective, while a mere one in ten rated them as being effective, highlighting widespread frustration with conventional practices. These results resonate (Keerthana, 2024), who stressed that the operational inefficiencies of conventional banking system in international payments. Respondents cited the biggest efficiency challenges as: transaction delays (35%), high intermediary fees (30%), exchange rate losses (20%) and manual documentation processes (15%). They said these inefficiencies drive up costs and restrict the flow of money from overseas. When it comes to blockchain’s perceived benefits, the most important efficiency benefits were regarded as speed of settlement (38%), cost saving on transactions (32%) and disintermediation (20%), and automation via smart contracts (10%). This corresponds to results from (Niu & Kantorovitch, 2024) that indicated blockchain could cut global banks’ costs by billions of dollars per year through more efficient clearing and settlement processes. On effectiveness, some 46 percent believed the technology could greatly improve efficiency and reduce costs, 30 percent said it would do so to some extent but one in seven were unclear while a further one in ten were skeptical, citing issues such as scalability, energy consumption and integrating with systems the companies already have. Yet the consensus is that, in theory at least, blockchain is considered to be a solution to antiquated structures, products and services of the past that are too slow and costly. In the end, inefficiency and cost continue to make transfers across borders a pain point for many businesses in today’s world even if blockchain has yet to mature. But the findings also reveals that for full cost efficiency to be realized, there will need to be mass adoption, regulator harmony across the globe and technical standardization so that it works on all banking networks. Across the two types of professionals, bankers and payers valued most highly blockchain’s potential to achieve operational cost reduction, while fintech professionals placed efficiency and automation capabilities at the top.

4.6 Adoption Intension

Intention to adopt refers to the propensity of users and institutions to accept blockchain as a legitimate replacement for existing cross-border payment systems.

Figure 6: Blockchain Adoption Intention and Influencing Factors.

This study found that 58% of participants had high intention to use a service with a blockchain-and 27% said they would have moderate intention; only 15% reported low or no intention to do so (figure 6). This indicates that most of the respondents believed that blockchain is a feasible and useful innovation for international banks. These findings are consistent with (Putra et al., 2024) that perceived usefulness, efficiency, a nd transparency significantly influence adoption intention in financial technology. When asked what will be the primary drivers of adoption, improved security (30%), cost savings (25%) and faster settlements (20%) were most mentioned, with 15% referring to greater transparency and 10% increased customer confidence. This suggests that respondents’ choice to adopt was highly influenced by the technological and financial advantages blockchain provides over legacy systems. But there were also a number of barriers. Regulatory ambiguity (28%), institutional unpreparedness (24%), technological complexity (22%) and limited awareness or training (16%) were considered significant challenges, although 10% noted that they are worried about the scalability consequences and energy consumption. These barriers are supported by (X. Wang, 2022) who highlighted that the use of blockchain in global banking has been inhibited due to regulatory and infrastructure gaps. On the whole, the findings indicate a positive intent to adopt with most participants acknowledging that blockchain has potential for addressing inefficiencies in cross-border payments. However, the conversation underscores that for on a broad scale breakthrough to be achieved will require harmonization of regulation, infrastructure investment and financial institution capacity building to address current impediments. These adoption intention results are consistent with the Technology Acceptance Model (TAM) and value factors, perceived utility and trust as key predictors of user's intention to adopt new technologies similar to blockchain technology in banking. A subgroup analysis further showed that bankers were more concerned about regulatory risk, whereas fintech participants considered scalability as the key factor in deciding to implement it, which indicated role-mediated perceptions of readiness to adopt.

4.7 User Satisfaction

User satisfaction is an important criterion to judge the success of a financial innovation as it indicates whether it fulfills user’s demands in terms of security, visibility, speed and trust.

Figure 7: Blockchain's Edge in User Satisfaction.

This study found that 64% were satisfied if blockchain technology was used for cross-border payments, and 22% were explained as neutral; only 14% expressed dissatisfaction cutting across low and no satisfaction (Figure 7). That means that Blockchain is, in general considered a user centered innovation, which can provide satisfaction from traditional systems. These results are consistent with those of (Taherdoost, 2023), who stated that customer experience through security, saving and speedy transaction was enhanced by the blockchain-based financial service. Asked which feature was the most responsible for their satisfaction, 32 percent highlighted transaction speed, 28 percent mentioned improved security and fraud protection, 20 percent found it easier to understand fee structures and tracking transactions (15%) versus five per cent who said trust in a decentralized system. This shows a strong correlation between satisfaction and the capacity of blockchain to solve current irritations present in traditional banking, such as delays, hidden fees or lack of transparency. Some respondents roughly 18% remain negative or neutral, citing issues around technical complexity, uncertain regulations and institutional adoption that may impede a smooth user experience. This view aligns with (Robinson et al., 2024) who contended that although blockchain technologies have transformative potential, the substantive impact on end-user welfare will be largely determined by proper regulatory integration and widespread institutional support. In conclusion, the results indicate that blockchain has great potential for substantial enhancement of user satisfaction in cross-border payments through both speed and security of its transactions as well as transparency. At the same time, the conversation reflects that enduring fulfillment rests not only on technology's reliability, but also with rules and access points and adoption throughout the world's banking system. Additional analysis revealed that fintech professionals were more satisfied because they are familiar with digital transaction systems, whereas banking personnel were satisfied only about security enhancement and observation of compliance.

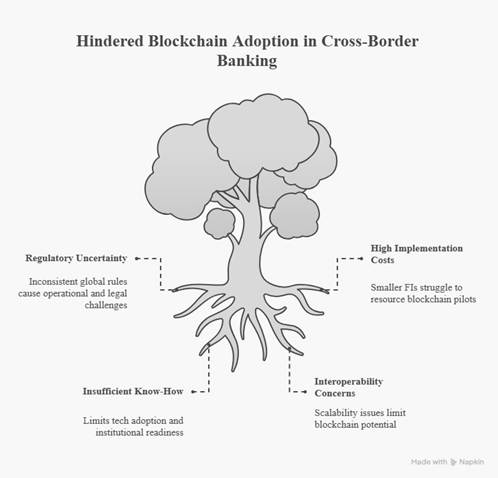

4.8 Challenges and Implications of Blockchain Adoption

Although blockchain was characterized by promising opportunities in the context of security, transparency, efficiency and customer satisfaction, the study identified several considerable challenges affecting its adoption in cross-border banking.

Figure 8: Challenges and Implications of Blockchain Adoption

According to the results, regulatory uncertainty (34%) was identified as the top-ranked challenge, closely followed by high implementation costs (28%), insufficient level of technological know-how and institutional readiness (20%), and interoperability and scalability concerns (18%) (Figure 8). These results are in line with the indicators provided by (Bellamkonda, 2024) which indicated that financial technology adoption is often limited by regulatory uncertainties, infrastructure shortages and operational complexity. Respondents also highlighted broader implications. On the positive side, costs savings by Blockchain could lessen reliance on middlemen, improve compliance reporting, and drive global financial inclusion particularly for under banked populations. But attendees emphasized that without consistent global rules, banks risk potential operational challenges and legal arguments as well as uneven uptake between countries. This is in line with (Noch, 2024) that argued the disruptive nature of blockchain technology in banking is highly influenced by state and non-state organizational underpinnings within which it sits. In addition, the research found that smaller FIs find resourcing a challenge but the larger global banks are more able to run blockchain pilots. They could create differences between tech-savvy banks and laggards that become the basis of competition in world banking. As such we find that despite the transformational impact the technology has on cross-border payment potential to reduce fraud, enhance efficiency and increase trust in payments it can only become successful if it can address structural challenges. The conversation concludes that among regulators, banks, and technology firms’ collaboration is key in co-creating a conducive ecosystem ensuring benefits are reaped exploitatively while threats thereto are mitigated or transferred.

5. Findings

· The study found that blockchain provided increased security in cross-border payments through mitigating fraud and eliminating unauthorized access to the transaction.

· It was found that transparency (with ability to track transactions real-time) is higher with blockchain, leading to reduced hidden costs.

· It was found that blockchain increases trust in the global banking system, with respondents believing in decentralized services over business as usual intermediaries.

· The report added that blockchain has increased efficiency and is less expensive, providing a faster settlement process and lower fees than traditional systems.

· It was found that participants had a positive adoption intention but regulatory uncertainty, high implementation costs and institutional readiness are some of the significant barriers.

6. Recommendations

· Regulatory authorities need to provide precise and consistent regulatory guidelines in order to alleviate uncertainty surrounding blockchain technologies which are necessary to promote the adoption of blockchain in cross-border banking.

· With ever-growing trust gaps in society, banks need to adopt technology infrastructure and skills advancement to be well-prepared for integration of blockchain.

· Banks should work with Fintech providers to create secure, auditable and scalable blockchain solutions.

· Awareness and education of users on the advantages of blockchain in terms of security, transparency and efficiency should be enhanced.

· To facilitate equality, regulators and banks ought to incentivize or collaborate with smaller institutions to develop the use of blockchain infrastructures.

· World Bank networks need to be stimulating interoperability standards to facilitate smooth trans-border transaction on different blockchain platforms.

7. Conclusion

This research proved that blockchain has the enormous capability to revolutionize cross-border payments in international banking system where it can improve security, transparency, trust, efficiency and cost. Results showed that both users and financial experts had strong intention to adopt blockchain, believing that it could respond to the risk of frauds, concealed costs, and delay often associated with traditional systems. It also identified major obstacles such as regulatory uncertainty, the high cost of implementation and limited institutional preparedness to slow a wider rollout. This suggests that the blockchain may indeed enable more financial inclusion and also enhance competition in the banking sector, on condition that regulators, banks and technology providers collaborate to create a conducive ecosystem. In the long run, it is more than a technological leap forward; it’s a strategic bridge to an even more secure, transparent and reliable worldwide financial system.

8. Limitations and Future Research

We noted that this study was constrained to perception and not necessarily actual behaviour, where it is possible for organizations or individuals to indicate use of blockchain international payment systems but do not really do so. Mixed method approach or longitudinal design might be considered in future research to gain deeper insights into actual adoption behaviors and long-term outcomes. Furthermore, technical exposure (e.g. smart contract risks, interoperability issues, and cybersecurity threats) deserved further examination. Comparative crosscountry studies could also provide some insights on how regulatory environment and market readiness affect the adoption of blockchain in international financial systems.

9. References

[1] Adrian, T., Garratt, R., He, D., & Griffoli, T. M. (2023). Trust Bridges and Money Flows: A Digital Marketplace to Improve Cross-Border Payments. FinTech Notes, 2023(001). https://doi.org/10.5089/9798400227073.063.A001

[2] Agrawal, R., & Verma, A. (2024). IMPACT OF DIGITAL PAYMENT SYSTEMS ON CUSTOMER SATISFACTION IN THE BANKING INDUSTRY: A STUDY. ShodhKosh: Journal of Visual and Performing Arts, 5(1), 2624–2633. https://doi.org/10.29121/shodhkosh.v5.i1.2024.2777

[3] Alam, N., Hasan Tanvir, M. R., Shanto, S. A., Israt, F., Rahman, A., & Momotaj, S. (2021). Blockchain Based Counterfeit Medicine Authentication System. 2021 IEEE 11th IEEE Symposium on Computer Applications & Industrial Electronics (ISCAIE), 214–217. https://doi.org/10.1109/ISCAIE51753.2021.9431789

[4] Alevizos, L., & Ta, V. T. (2024). Automated Cybersecurity Compliance and Threat Response Using AI, Blockchain & Smart Contracts.

[5] Baftijari, A. B., Nakov, L., Baftijari, A. B., & Nakov, L. (2024). The Architecture of Blockchain Technology and Beyond. In Cryptocurrencies—Financial Technologies of the Future. IntechOpen. https://doi.org/10.5772/intechopen.1004138

[6] Bellamkonda, S. (2024). Securing Real-Time Payment Systems: Challenges and Solutions for Network Security in Banking. IJFMR - International Journal For Multidisciplinary Research, 6(6). https://doi.org/10.36948/ijfmr.2024.v06i06.31388

[7] Bhuiyan, Md. M. H., Dey, K. N., Saha, P., Sarker, P. K., Md. Halimuzzaman, & Biswas, Md. T. (2025). EXPLORING THE ROLE OF ARTIFICIAL INTELLIGENCE IN TRANSFORMING HR PRACTICES. International Journal of Business Management and Economic Review, 08(01), 98–110. https://doi.org/10.35409/IJBMER.2025.3646

[8] Cochran, W. G. (1942). Sampling Theory When the Sampling-Units are of Unequal Sizes. Journal of the American Statistical Association, 199–212.

[9] Devisri, M., Vetriselvan, V., Baskar, M., Mylapalli, M., Jayabalan, K., Mouli, S. K. M. K., Devisri, M., Vetriselvan, V., Baskar, M., Mylapalli, M., Jayabalan, K., & Mouli, S. K. M. K. (2024). Blockchain Innovations for Secure Online Transactions (blockchain-innovations-for-secure-online-transactions) [Chapter]. Https://Services.Igi-Global.Com/Resolvedoi/Resolve.Aspx?Doi=10.4018/979-8-3693-6557-1.Ch021; IGI Global Scientific Publishing. https://doi.org/10.4018/979-8-3693-6557-1.ch021

[10] Halimuzzaman, M., & Sharma, J. (2024). The Role of Enterprise Resource Planning (ERP) in Improving the Accounting Information System for Organizations. In Revolutionizing the AI-Digital Landscape. Productivity Press.

[11] Halimuzzaman, M., Sharma, J., & Khang, A. (2024). Enterprise Resource Planning and Accounting Information Systems: Modeling the Relationship in Manufacturing. In Machine Vision and Industrial Robotics in Manufacturing. CRC Press.

[12] Hashimzai, I. A., & Ahmadzai, M. Z. (2024). Navigating the Integration of Blockchain Technology in Banking: Opportunities and Challenges. International Journal Software Engineering and Computer Science (IJSECS), 4(2), 665–679. https://doi.org/10.35870/ijsecs.v4i2.2656

[13] Hossen, M. A., SalmanAlMamun, K. M., Das, R. C., Iqbal, S. M. Z., & Halimuzzaman, M. (2025). Assessing the Adoption of IFRS and Its Effects on Financial Reporting Quality in Developing Countries. Business and Social Sciences, 3(1), 1–9. https://doi.org/10.25163/business.3110312

[14] Islam, M. S. H., Rubel, M. R. B., Hossain, M. I., Kamruzzaman, M., Akter, S., Halimuzzaman, M., & Karim, M. R. (2024). Impact of financial and internet support on SME performance: Moderating effect of technology adoption during COVID-19 pandemic. World Journal of Advanced Engineering Technology and Sciences, 13(2), 105–118. https://doi.org/10.30574/wjaets.2024.13.2.0533

[15] Juita, V., Pujani, V., Rahim, R., & Rahayu, R. (2023). Gender Differences in Financial Technology (FINTECH) Adoption in Indonesia: An Analysis of Risk Perceptions and Benefits. Riset Akuntansi Dan Keuangan Indonesia, 8(2), 145–158. https://doi.org/10.23917/reaksi.v8i2.2308

[16] Keerthana, K. (2024). Blockchain Integration in Banking: A Fintech Revolution. Shanlax International Journal of Management, 11(S1-Mar), 114–121. https://doi.org/10.34293/management.v11iS1-Mar.8066

[17] Lu, S., Liang, S., Xue, Q., & Bian, H. (2024). Enhancing cross-border payments: The convergence of AI and blockchain for currency exchange optimization. Applied and Computational Engineering, 75, 160–165. https://doi.org/10.54254/2755-2721/75/20240531

[18] Md Sharfuddin, Md. Halimuzzaman, Farzana Akter, Kripa Nath Dey, & Palash Saha. (2025). Employee Motivation and Behavior in Construction Engineering Projects. International Journal of Social Science and Economic Research. https://doi.org/10.46609/IJSSER.2025.v10i01.019

[19] Niu, Y., & Kantorovitch, I. (2024). Bitcoin and Shadow Exchange Rates (arXiv:2410.22443). arXiv. https://doi.org/10.48550/arXiv.2410.22443

[20] Noch, M. Y. (2024). The Application of Blockchain Technology in International Financial Management: Opportunities and Challenges. Golden Ratio of Mapping Idea and Literature Format, 4(2), 154–166. https://doi.org/10.52970/grmilf.v4i2.396

[21] Norbu, T., Park, J. Y., Wong, K. W., & Cui, H. (2024). Factors Affecting Trust and Acceptance for Blockchain Adoption in Digital Payment Systems: A Systematic Review. Future Internet, 16(3), 106. https://doi.org/10.3390/fi16030106

[22] Putra, R. A., Ardiansyah, R., Pusadan, M. Y., Kasim, A. A., & Joefrie, Y. Y. (2024). Developing Decentralized Data Storage Network Using Blockchain Technology to Prevent Data Alteration. Advance Sustainable Science, Engineering and Technology, 6(1), 02401017. https://doi.org/10.26877/asset.v6i1.17772

[23] Rajest, S. S., & Regin, R. (2024). Revolutionizing the Banking Industry: The Impact of Blockchain Technology on Financial Services. American Journal of Economics and Business Management, 7(9), 709–723. https://doi.org/10.31150/ajebm.v7i9.2939

[24] Robinson, G., Dörry, S., & Derudder, B. (2024). Preserving the obligatory passage point: SWIFT and the partial platformisation of global payments. Geoforum, 151, 104007. https://doi.org/10.1016/j.geoforum.2024.104007

[25] Shams, A. K., & Hamdan, A. (2023). The Role of Blockchain in Transforming the Financial Sector. In R. El Khoury & N. Nasrallah (Eds.), Emerging Trends and Innovation in Business and Finance (pp. 769–775). Springer Nature. https://doi.org/10.1007/978-981-99-6101-6_57

[26] Syarkani, Y., Subu, M. A., & Waluyo, I. (2024). Revolutionizing Financial Risk Management: Blockchain’s Role in Transforming Global Banking Systems. Moneta : Journal of Economics and Finance, 2(4), 143–157. https://doi.org/10.61978/moneta.v2i4.378

[27] Taherdoost, H. (2023). The Role of Blockchain in Medical Data Sharing. Cryptography, 7(3), Article 3. https://doi.org/10.3390/cryptography7030036

[28] Udeh, E. O., Amajuoyi, P., Adeusi, K. B., & Scott, A. O. (2024). Blockchain-driven communication in banking: Enhancing transparency and trust with distributed ledger technology. Finance & Accounting Research Journal, 6(6), 851–867. https://doi.org/10.51594/farj.v6i6.1182

[29] Ugo, G. C., Apata, A. C., & Dawodu, P. O. (2024). A Multi-Stakeholder Perspective on the Limitations of Implementing Artificial Intelligence in Highway Transport. Journal of Engineering Research and Reports, 26(2), 243–249. https://doi.org/10.9734/jerr/2024/v26i21086

[30] Wang, X. (2022). Research on Payment Settlement Mode in Cross-Border Business Trade Based on Blockchain Technology. SAIEE Africa Research Journal, 113(3), 129–132. https://doi.org/10.23919/SAIEE.2022.9853022

[31] Wang, Z.-J., Chen, Z.-S., Xiao, L., Su, Q., Govindan, K., & Skibniewski, M. J. (2023). Blockchain adoption in sustainable supply chains for Industry 5.0: A multistakeholder perspective. Journal of Innovation & Knowledge, 8(4), 100425. https://doi.org/10.1016/j.jik.2023.100425

[32] Yadav, S., Kushwaha, S., Singh, S., & Singh, T. (2024). THE ROLE OF BLOCKCHAIN IN REVOLUTIONIZING TRANSPARENCY AND EFFICIENCY IN MODERN BANKING. ShodhKosh: Journal of Visual and Performing Arts, 5(1), 1023–1030. https://doi.org/10.29121/shodhkosh.v5.i1.2024.2597

[33] Zulaikha, S., Mohamed, H., & Rosyidi, L. N. (2024). Smart contracts on blockchain for insurance and Takaful industry. Insurance Markets and Companies, 15(2), 85–93. https://doi.org/10.21511/ins.15(2).2024.08